Beyond traditional plans: The smart choice for healthy workforces

Level-funded employer health plans: A cost-effective solution for employers seeking to cover their workforce

Published: Feb. 10, 2025

Managing health care costs is a top priority for business decision makers. With the cost of traditional fully-insured health plans continuing to rise, employers are seeking innovative solutions to provide quality coverage to their employees while controlling costs. For companies with stable, healthy employee bases with low claims, and that don’t want the full risk of self-insurance, level-funded employer health plans offer a compelling alternative.

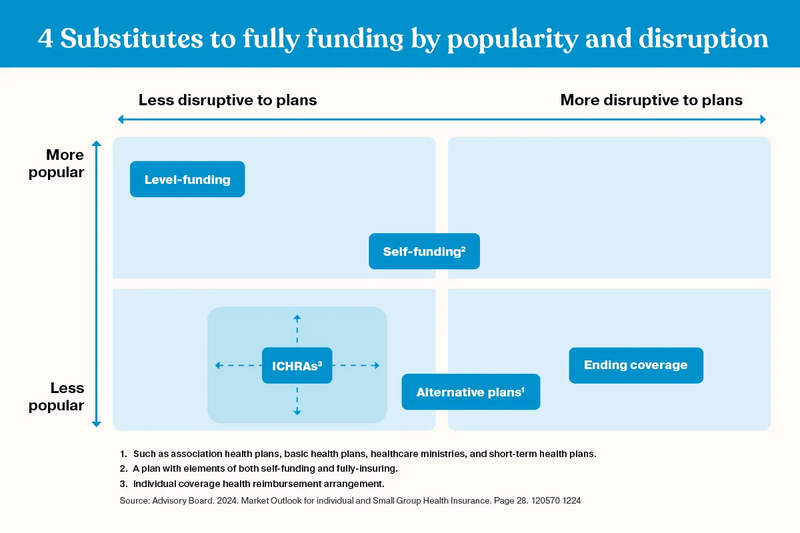

Rising popularity in fully-funded substitutions

For example, according to 2024 Advisory Board Study, level-funding is becoming a particularly popular option for small employers without being disruptive to plans.1

In fact, unlike fully- insured or working uninsured programs which utilize Health Insurance Marketplace plans, the customizable nature of level-funded plans can help employers provide quality coverage to their workforce while minimizing the financial burden.

How level-funded plans work

Level-funded plans, also known as balance funded plans or partially self-insured plans, combine the benefits of self-insurance with the predictability of fully-insured plans. Under this arrangement, the employer pays a fixed monthly premium to a third-party administrator (TPA) or insurance carrier, which covers the costs of claims, administrative fees, and stop-loss insurance.

The key difference between level-funded and fully-insured plans lies in the way claims are handled. With level-funded plans, the employer is responsible for paying claims up to a predetermined amount, after which the stop-loss insurance kicks in to cover excess claims.

Benefits of level-funded plans for healthy workforces

Employers who have invested in creating a healthy and productive work environment — resulting in a low claims experience — have a unique opportunity. With level-funded plans, they can optimize their health care spend while maintaining quality coverage for their employees. These plans can offer several advantages including:

- Cost savings: By paying only for the actual claims incurred, employers can avoid the higher premiums associated with fully-insured plans, which often include built-in margins.

- Transparency and control: Employers have access to detailed claims data, enabling them to identify trends and areas for cost containment.

- Flexibility and customization: Employers can design their plans to meet the specific needs of their workforce, including selecting from a range of network options, deductible levels, and benefit designs. These plans can accommodate different types of employees, even those who may not be eligible for traditional group health insurance.

- Tax advantages: Level-funded plans can help employers avoid the Affordable Care Act’s’ (ACA) ““Cadillac Tax,”” which imposes a 40% excise tax on high-cost health plans.2

Identifying who is a good fit for a level-funded plan

The suitability of a level-funded health plan arrangement depends on the specific needs and circumstances of the employer. To determine the best approach for your business, it’s’ essential to consult with a local agent or broker who can provide personalized guidance. Employers should consider their organization’s:

- Benefits strategy: Employers who want to offer rich benefits, but also want to manage costs and have more control over their health plan, may find level-funded plans attractive.

- Workforce health: Employers with a stable and relatively healthy workforce are ideal candidates for level-funded plans. A low claims history or stable claims trend can lead to premium savings. However, factors like chronic conditions, claims frequency, and employee demographics can impact compatibility.

- Claims history: Employers with a relatively low claims history or a stable claim trend also are better suited for level-funded plans. This is because the plan’s’ funding is based on the employer’s’ expected claims, and a low claims history can result in lower funding requirements.

- Risk tolerance: Employers who are comfortable with some level of risk and are willing to take on the potential for higher claims costs in exchange for lower premiums may be a good fit for level-funded plans. An organization’s risk appetite and understanding financial stability are key here to make an informed decision.

Adopting level-funded plans puts employers ahead

As the health care market continues to shift, one thing is clear: employers who adopt level-funded plans will be better positioned to navigate the challenges ahead, drive business success, and create a healthier, more productive workforce. Rather than being locked into a one-size-fits-all plan, a level-funded health plan can be an attractive option for healthy workforces, including those with part-time or seasonal workers, or even industries with high turnover rates. These plans offer a compelling alternative to traditional fully-insured arrangements. Business decision makers seeking to optimize their health care spend while maintaining quality coverage for their employees should consider level-funded plans as a viable solution. With the right plan design and administration, employers can reap the benefits of level-funded plans and achieve a healthier bottom line.

References:

1Advisory Board. 2024. Market Outlook for Individual and Small Group Health Insurance. Page 28.

2Kaiser Family Foundation. “Analysis: ‘Cadillac Tax’ on High-Cost Health Plans Could Affect 1 in 5 Employers in 2022.” 2019. https://www.kff.org/private-insurance/press-release/analysis-cadillac-tax-on-high-cost-health-plans-could-affect-1-in-5-employers-in-2022/

More Health Care Industry Insights